1.2.3 Price, Income & Cross Elasticities of Demand

Edexcel A-Level Economics (9EC0) | Theme 1.2.3

Price Elasticity of Demand (PED)

Definition: PED measures the responsiveness of quantity demanded to a change in the good's own price.

| PED Value | Classification | Explanation & Example |

|---|---|---|

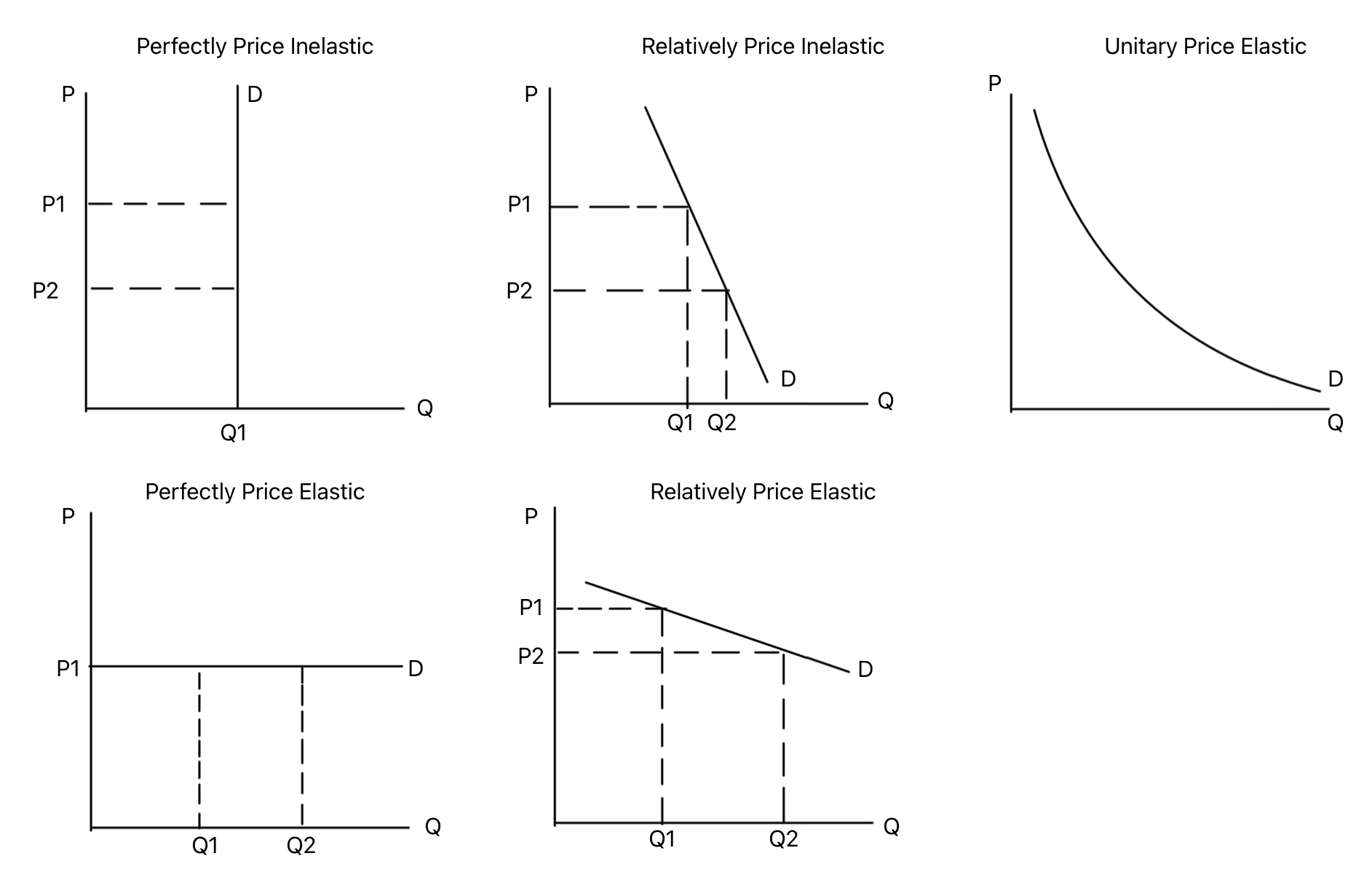

| \[ \text{PED} = 0 \] | Perfectly inelastic | Quantity demanded does not respond to price changes (theoretical, e.g., essential medicine). |

| \[ 0 < \text{PED} < 1 \] | Relatively inelastic | Quantity demanded changes by a smaller percentage than the price change (e.g., necessities, addictive goods). |

| \[ \text{PED} = 1 \] | Unitary elasticity | Quantity demanded changes by the exact same percentage as the price. |

| \[ \text{PED} > 1 \] | Relatively elastic | Quantity demanded changes by a larger percentage than the price change (e.g., luxuries, goods with many substitutes). |

| \[ \text{PED} = \infty \] | Perfectly elastic | Any price increase causes quantity demanded to fall to zero (theoretical). |

Key Determinants of PED:

- Number & Closeness of Substitutes: More/better substitutes mean higher (more elastic) PED.

- Necessity vs. Luxury: Necessities tend to be price inelastic; luxuries tend to be elastic.

- Proportion of Income: Goods that take a large portion of income tend to be more price elastic.

- Time Period: Demand becomes more elastic over the long run as consumers find alternatives.

Income Elasticity of Demand (YED)

Definition: YED measures the responsiveness of quantity demanded to a change in consumer income.

| YED Value | Classification | Explanation & Example |

|---|---|---|

| \[ \text{YED} > 1 \] | Income elastic luxury | Demand increases more than proportionally to income (e.g., holidays, designer goods). |

| \[ 0 < \text{YED} < 1 \] | Income inelastic necessity | Demand increases but less than proportionally to income (e.g., food, basic clothing). |

| \[ \text{YED} = 0 \] | Income independent | Demand does not change with income (rare, theoretical). |

| \[ \text{YED} < 0 \] | Inferior Good | Demand decreases as income rises (e.g., budget brands, bus travel). |

Cross Elasticity of Demand (XED)

Definition: XED measures the responsiveness of quantity demanded for Good A to a change in the price of Good B.

| XED Value | Relationship | Explanation & Example |

|---|---|---|

| \[ \text{XED} > 0 \] | Substitutes | A rise in the price of Good B increases demand for Good A (e.g., Coke and Pepsi). A higher positive value indicates stronger substitutability. |

| \[ \text{XED} < 0 \] | Complements | A rise in the price of Good B decreases demand for Good A (e.g., printers and ink). A lower negative value (e.g., -2.5) indicates stronger complementarity. |

| \[ \text{XED} = 0 \] | Unrelated goods | No relationship between the two products. |

Significance of Elasticities

For Firms:

PED & Revenue: To maximise revenue, a firm should raise price if demand is inelastic (PED < 1) and lower price if demand is elastic (PED > 1).

YED: Helps plan for the economic cycle. Produce/sell more luxuries in booms and more inferior goods in recessions.

XED: Informs pricing and competitive strategy. Understanding complements and substitutes is vital.

For Governments:

PED & Taxation: Placing an indirect tax on goods with inelastic demand (e.g., cigarettes) raises significant tax revenue with a relatively small fall in quantity. Taxing elastic goods can severely reduce sales and employment.

PED & Subsidies: Subsidising goods with elastic demand (e.g., green tech) can cause a large increase in consumption.

Key Exam Tips

-

Calculations: Be confident calculating %

changes and each elasticity. Show your working.

\[ \%\Delta = \frac{\text{New} - \text{Old}}{(\text{New} + \text{Old})/2} \times 100 \]

- Interpretation: The sign (positive/negative) of YED and XED is as important as the number. For PED, the number's size is key.

- Application: Always link the numerical result to its real-world meaning (e.g., PED = -0.4 means demand is inelastic, so a tax will be largely passed to the consumer").

- Evaluation: Elasticity is not static—it can change over time or if the price change is very large.